Introduction

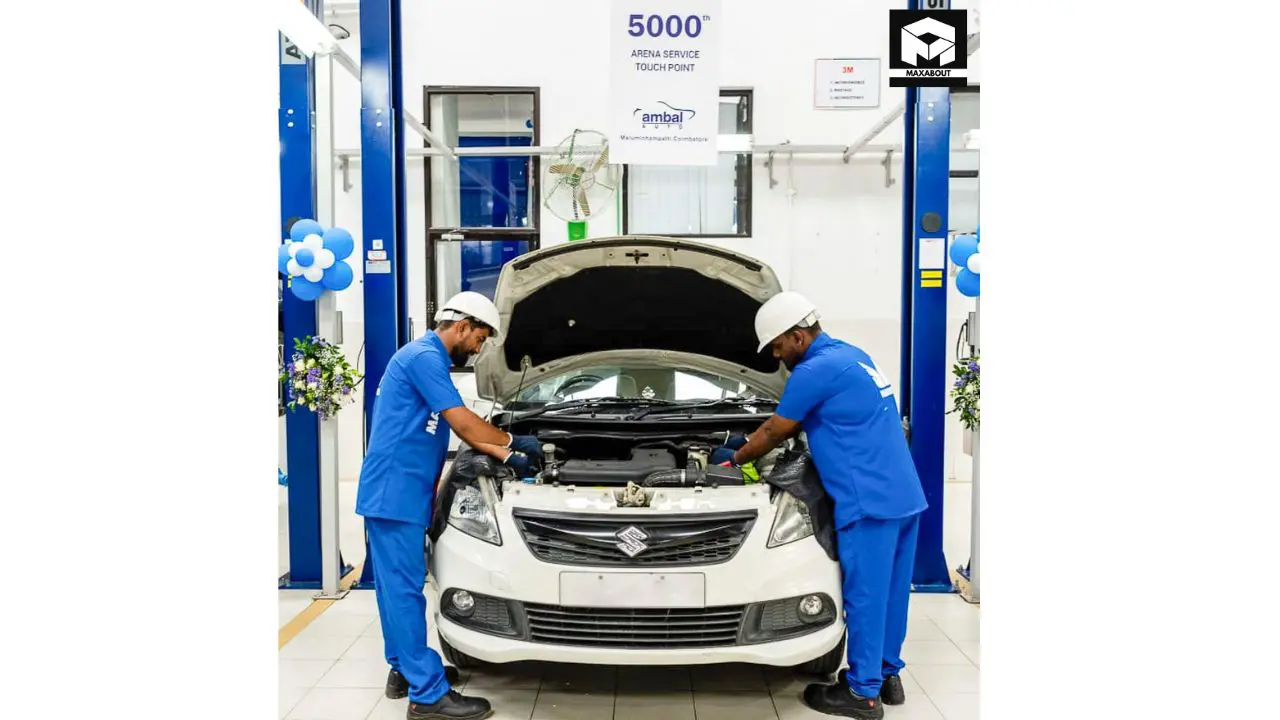

In a significant development for India's automotive landscape, Maruti Suzuki India Limited (MSIL) has recently achieved a remarkable milestone by inaugurating its 5,000th Arena service outlet. As someone who's followed the automotive industry closely for years, I can confidently say this expansion represents one of the most aggressive service network growth strategies in the Indian market.

The company isn't resting on its laurels either—Maruti has already announced plans to add approximately 500 more service centers in the upcoming financial year 2025-26. This expansion further strengthens Maruti Suzuki's position as the auto manufacturer with the most extensive service network in India.

Milestone Achievement: 5,000 Service Centers

The 5,000th service center marks a pivotal moment in Maruti's customer service journey. According to the company's official announcement, this achievement comes as part of their sustained effort to enhance accessibility for customers across India. The Arena network specifically caters to Maruti's mainstream vehicle lineup, which forms the backbone of their sales volume.

From what industry reports indicate, Maruti Suzuki has been systematically expanding its service network at an impressive pace over the past decade. The company has added approximately 1,000 new service centers just in the last three years, which demonstrates their aggressive approach to maintaining service leadership.

Service Network Distribution

What's particularly noteworthy is how Maruti has distributed these service centers. Based on company data, the network covers:

- Over 2,250 cities and towns across India

- Strong presence in metro and tier-1 cities

- Significant expansion into tier-2 and tier-3 markets

- Strategic placement in high-traffic corridors and emerging markets

This geographical spread ensures that Maruti vehicle owners can find authorized service centers within reasonable distances, regardless of their location—a crucial advantage in a country as vast and diverse as India.

Strategic Importance of Service Network Expansion

From a business perspective, this expansion carries significant strategic importance. The automotive industry has long recognized that after-sales service is a critical factor in customer retention and brand loyalty.

Studies consistently show that customers who have positive service experiences are significantly more likely to repurchase the same brand. According to automotive industry analysts, a robust service network provides multiple advantages:

Customer Confidence and Brand Trust

When customers know they can find authorized service centers easily, it builds confidence in the purchase decision. Industry data suggests that service availability ranks among the top five factors influencing car buying decisions in India.

I've observed that many customers explicitly mention Maruti's extensive service network as a key reason for choosing the brand, especially for those who travel frequently or live in smaller cities.

Revenue Stream Diversification

Service operations represent a significant revenue stream for automotive companies. As per automotive industry reports, after-sales service typically generates higher profit margins than new vehicle sales, making this expansion financially strategic as well.

The consistent cash flow from service operations helps buffer against fluctuations in new vehicle sales, creating a more stable business model.

Plans for FY26: Adding 500 More Service Centers

Looking ahead, Maruti Suzuki's plan to add approximately 500 additional service centers in FY26 represents a continuation of their customer-centric approach. Based on company statements, this expansion will focus on:

- Filling geographical gaps in the current network

- Enhancing capacity in high-demand areas

- Expanding into emerging markets and newly developed areas

- Reducing the average distance between service centers

The addition of these 500 centers would bring Maruti's total service network to around 5,500 outlets by the end of FY26, further widening the gap between Maruti and its competitors.

Investment and Employment Generation

According to automotive industry estimates, each new service center represents a significant investment in infrastructure, equipment, and training. Beyond the direct benefits to customers, this expansion is likely to generate substantial employment opportunities.

Based on standard industry metrics, these 500 new centers could potentially create 5,000-7,500 direct jobs for technicians, service advisors, and administrative staff, not counting indirect employment through the supply chain.

Customer Benefits from Expanded Service Network

The primary beneficiaries of this expansion are Maruti vehicle owners. Industry reports consistently highlight several key advantages that an extensive service network provides:

Reduced Wait Times and Better Accessibility

More service centers translate to lower waiting periods for routine maintenance and repairs. Customer satisfaction surveys across the automotive industry show that service appointment availability and waiting time are among the top pain points for car owners.

With over 5,000 centers (and growing), Maruti customers can typically find appointment slots more readily than owners of other brands with smaller networks.

Standardized Service Quality

Maruti has implemented standardized service protocols across its network. According to company information, all service centers follow identical quality processes, use genuine parts, and employ technicians trained using the same curriculum.

This standardization helps ensure consistent service experiences regardless of location—a crucial factor for customers who travel between cities or relocate frequently.

Competitive Service Costs

The scale of Maruti's service operation allows for economies of scale in parts procurement and logistics. Industry analysis suggests that Maruti has been able to maintain competitive service pricing partly due to these efficiencies.

For customers, this often translates to more affordable maintenance costs compared to some competitor brands with smaller service footprints.

Competitive Landscape and Market Position

This expansion further cements Maruti Suzuki's dominant position in India's automotive service sector. Based on publicly available data, Maruti's closest competitors typically have service networks ranging from 1,000-2,000 outlets—significantly smaller than Maruti's 5,000+ centers.

This service network advantage creates a substantial competitive moat that other manufacturers find challenging to overcome, particularly in tier-2 and tier-3 markets where establishing service infrastructure requires significant investment.

Customer Retention Strategy

From a strategic perspective, the service network plays a crucial role in Maruti's customer retention efforts. Industry data indicates that customers who regularly service their vehicles at authorized centers demonstrate higher brand loyalty and are more likely to purchase another vehicle from the same manufacturer.

By expanding their service footprint, Maruti is effectively strengthening its customer retention pipeline for future sales—a strategy that appears to be working well based on their consistent market leadership position.

Frequently Asked Questions

What is the difference between Maruti Arena service centers and NEXA service centers?

Maruti Arena service centers cater to mainstream Maruti models like Alto, Swift, Wagon R, and Dzire, while NEXA service centers handle premium models like Baleno, Ciaz, and Grand Vitara. The service protocols are similar, but NEXA centers typically offer additional premium amenities and experiences.

How does Maruti's service network compare to other manufacturers in India?

Based on publicly available data, Maruti's service network of 5,000+ centers is significantly larger than its closest competitors. Most other manufacturers maintain networks of 1,000-2,000 service centers, giving Maruti a substantial advantage in service accessibility.

Will the expansion affect service costs for customers?

According to industry analysis, the expansion is unlikely to increase service costs. In fact, the greater scale may enable further efficiencies that could help Maruti maintain competitive service pricing despite inflationary pressures on parts and labor.

Conclusion

Maruti Suzuki's achievement of opening its 5,000th service center represents a significant milestone not just for the company, but for India's automotive ecosystem as a whole. The planned addition of 500 more centers in FY26 demonstrates a continued commitment to service excellence and customer satisfaction.

This expansion strategy aligns perfectly with India's growing automotive market, where service availability and quality increasingly influence purchase decisions. As vehicle ownership continues to rise across the country, particularly in smaller cities and towns, Maruti's extensive service network positions the company well for sustained leadership in the Indian market.

For consumers, this expansion promises greater convenience, standardized service quality, and potentially more competitive maintenance costs—all factors that contribute to a better overall ownership experience. It's a clear example of how infrastructure investment can create meaningful competitive advantages in the automotive sector.